The direction of vehicle

[Consumerwide - HueSoung Jun Reporter / Yohan Bok Reporter] The paradigm shift in the vehicle industry, which involves environmental and technological change, has resulted in the growth of Chinese manufacturers centred around Tesla and BYD, along with the expansion of the Chinese market globally based on their battery, AI, and S/W technologies. Meanwhile, major countries, such as the US, are focusing on protectionist policies to secure future industries in the global and national markets. Having all this background, it's been more emphasised the importance of coordinated work between government, academia, and the private sector. I had the opportunity to hear about the opinions of experts in public and private partnerships regarding the method to strengthen future competitiveness in the vehicle industry during a conference held to celebrate 21st Automobile Day on May 9 at 9:30 a.m. at the JW Marriott Hotel Gangnam Grand Ballroom.

The second story is about the direction of vehicle industries in Korea in order to complete the mission of adopting future mobility, referring to Go Taebong, the director of Hi Investment and Securities.

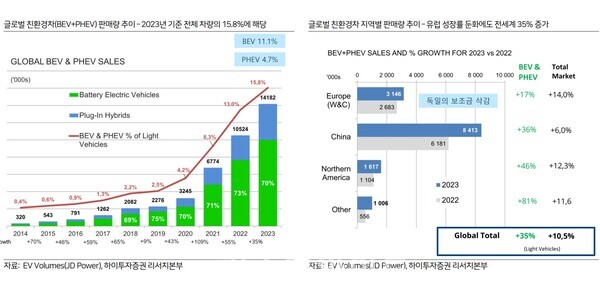

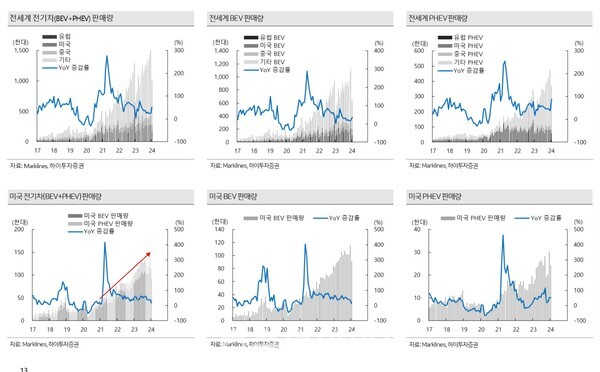

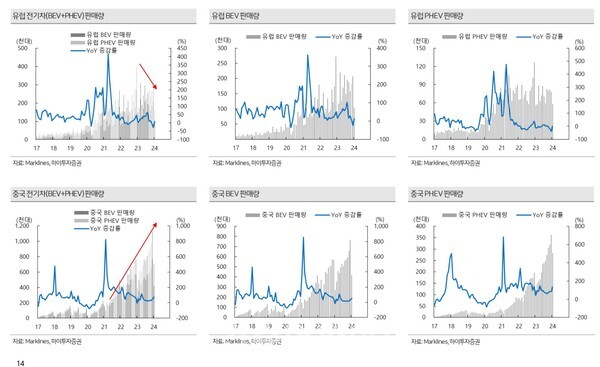

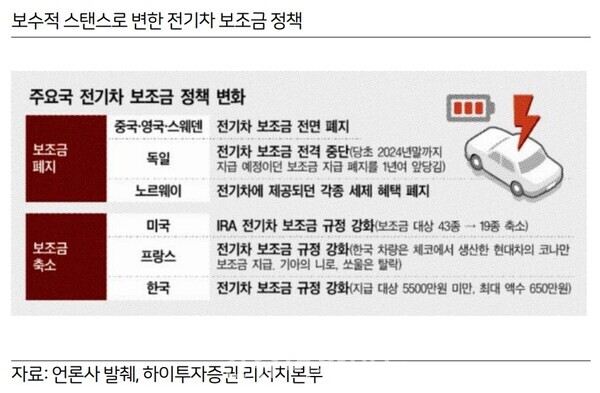

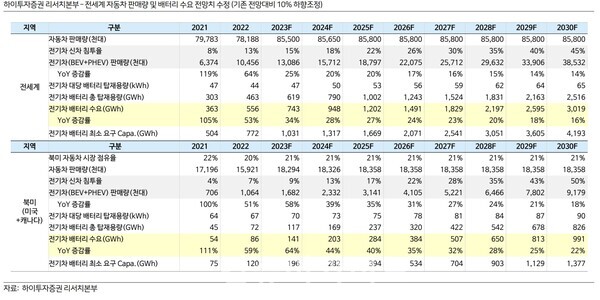

The EV trend is still going, though not as speedy as before. 14.18 million EVs were sold last year in the global market, which is a 35% increase from a year prior. A total of 15.8% of EVs entered the market, which includes 11.1% of BEVs and 4.7% of PHEVs. The largest EV sales were taken in China at 33.9%, Europe at 21.4%, and the US at 9.4%. Turkey counts as the market with the fastest growth, with 86,600 units sold during one year, which is an 805% increase. And, Brazil, Thailand, Malaysia, and Australia each recorded 50,400 units (a 359% increase), 89,000 units (a 328% increase), Malaysia 10,400 units (a 886% increase), and 93,000 units (a 141% increase). It is still a small market, yet the growth rate seems rapid. On the other hand, the European EV market, including Germany, seems to be slowing down due to an increase in government subsidies in other sectors, such as expenses related to COVID-19 and wars in Europe. The German government has stopped EV national subsidies for manufacturers in August 2023 and also stopped EV individual subsidies in December.

It might be slow, yet the EV market seems to be continually growing. The sales of light vehicles increased by 10.5% in 2023 compared to a year prior, and EV sales also increased by 35% in the global market, which reflects pent-up demand from two years of failure to secure semi-conductors after COVID 19. Exceptionally, BEV and PHEV market share has fallen from a year prior in Korea, Germany, Norway, and Italy. The sales record of the German market counts 122,000 units, which is a 6% fall caused by the withdrawal of national incentives. Meanwhile, 8.4 million units of EVs, which is 59% of all world EV sales, were sold, and 65% of global production, which counts 9.3 million units, was taken solely in China last year. A total of 0.9 million EVs were exported from China, and 0.53 million units of them are from western brands: Tesla, SAIC (MG, Maxus), Geely (Volvo, Polestar, Lynk, Smart), BYD, Renault (Dacia), BMW, and Great Wall. Among them, an EV battery manufacturer, BYD, is ranking one in BEV and PHEV based on their price competitiveness.

The future assignment of the vehicle industry in Korea

These are the improvement points regarding the vehicle industry in Korea, according to Go Taebong, the director. Supply chain, paradigm shift caused by EV, balance btw low profit and environmental cause, SDV transformation, high wage, lacking funds for environmental incentives, "Winner take all" paradigm issue in the market, lacking self driving and AI technologies, high interest rate, gaps between political view, accelerated price competitiveness, difficulties in data collection, high oil price, challenges from Chinese vehicle market, prioritising IT and battery techonologies, takingover softwear, OS, and semi conductor sectors, decrease of consumer disposable income, stagnant market and increasing participators, rapid convergenece in technologies, change in business model, more car parts businesses facing limit, rapid change in industry ecology system due to EV and AV, lacking charging infrastructure, standardization issue, rapid increase in using robot and smart factory in industry.

Go Taebong, the director, said, "Because of the cost increase in defence (Nato) and energy consumption due to the war, Europe decided to end their incentives for EVs. Besides, lowering the price can't resolve the ultimate problem, as the high interest rate and price set for EVs, particularly large EVs, keep the cost expensive. Additionally, lowering costs also lowers the price of second-hand vehicles (residual value), which will result in a profit loss for the entire industry. Eventually, it will get harder for businesses in the market to catch up with the trend, and the market will continually slow down.

The future direction of the vehicle industry in Korea.

What would be the next step for the vehicle industry in Korea?

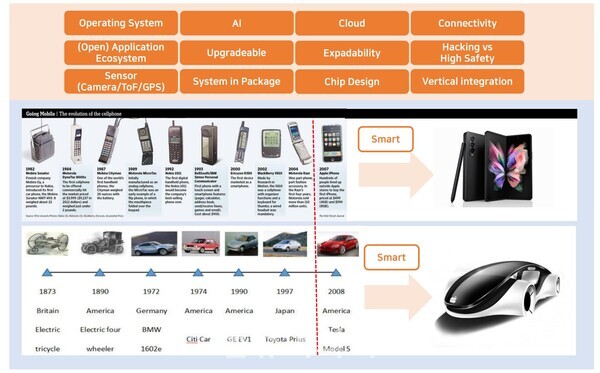

Go Taebong, the director of Hi Investment and Securities, said accurate comprehension of the current status of citizens in domestic areas, actively engaging in the supply chain that works the best, recovery of price competitiveness through production innovation, convergence to advanced IT technology, accelerating SDV transformation, securing a leading position in the SW, OS, AI, and DATA sectors, a strategic plan between ICE, HEV, BEV, and FCEV, changing nature to ICE→EV+AV, and changing the business model to TaaS (*testing as a service: outsourcing model to evaluate the performance of businesses).

Go Taegong, the director, said, "The vehicle industry in Korea has got to play the role of constructing a healthy supply chain, which completely benefits us, while contributing to restoring the manufacturing ecology of Korea based on an accurate perspective for the time to come. Korean vehicle manufacturers are peaking in business globally through their technology in the hybrid and ICE sectors; however, we've got to remember the case of the "Rust Belt" in the US and learn from it.

*Rust Belt: the geographic region from NY through the Midwest that was once dominated by manufacturing. Now it means "regions facing industrial decline and abandoned factories rusted from exposure to the elements." Investopedia

Our vehicle industry is behind in the competition. We've got to reach innovation in the production area through corporate work with businesses in other areas, such as Samsung, LG, Hynix, Kakao, and Naver. In order to highlight our technology, each element needs to reach a certain level equally, but we are still lacking the AI element. For this reason, I perceive that it is necessary to secure the AI sector, which is essential in the fourth industry innovation, with our technology."

Go Taebong, the director, also mentioned the importance of improving the price competitiveness of EVs. Price competitiveness matters for the early majority. (the group that is less conservative than the late majority but more conscious than early adopters in making purchase decisions.) If we take unboxed manufacturing and use robots for the assembly and combining processes, we can lower production costs by 50% while saving 40% of working space. Besides, 100% of robots can operate all the time without strike. This may lower vehicle costs."

Go Taebong, the director, predicted that self-driving technology will drive the market after the EV era. "The smartphone ended the era of feature phones, and the iPhone has changed the world. In the same way, I see that self-driving technology will drive the future market after EVs. Hyundai Motor and Samsung Electronics are making the core of a self-driving system by investing each 2 5% share. The internalisation of self-driving technology is important, but Hyundai Motor is not missing the self-driving contents on their target. The Korean government is planning on regulating self-driving drones by 2035. This means it will give new opportunities for success to our industry, including small parts businesses in Korea, as it is a new field for all. I hope businesses won't think of self-driving as someone else's story."

- [Consumption value-10th anniversary/In-Depth Report] 3 experts in public and private partnerships explore strategies to improve the vehicle sector's competitiveness ①

- [Consumption value-10th anniversary / In-Depth Report] Three experts in public and private partnerships explore strategies to improve the vehicle sector's competitiveness. ③