Editor's Note - This is an analysis of value consumption regarding the domestic new car sales trend in October. We propose rational consumption to consumers through our report.

[Consumerwide - HueSoung Jun Reporter / Yohan Bok Reporter] The sales record of new cars declined after a rebound. It seems to have been downward since a year prior. In the middle of an economic crisis and high oil prices, medium and small cars are more preferred than large cars in the market. Besides, sales of gasoline and diesel cars have decreased while sales of hybrid and electric cars have increased. In particular, electric cars were sold in large numbers. Environmental and rational value consumption might have increased. According to Opinet on the 9th, there had been a fall in sales prices of gasoline and diesel during four continuous weeks. The global oil price, which has been repeatedly fluctuating, began falling due to a reduction in Israel-Hamas war risk, a severe recession of the world economy, and an oil stock increase between states in the US during this week. It says continuous four-week fall, yet the sales prices of gasoline in overall domestic gas stations recorded 1,745.8 won per litre, which is 17.8 won lower than a week prior, during the first week of November. (October 29th∼November 2nd) In particular, the sales price in Seoul, which is known to be the most expensive in entire domestic areas, was 1,820.2 won per litre, which is 20.1 won lower than a week prior. This shouldn't be easy for consumers. Thus, the new car purchase trend in the domestic market is also changing. First of all, the sales record of new cars has rapidly decreased. The uptrend, which rebounded due to an increase in sales of Korean and overseas cars during September, has fallen swiftly in a month.

On the 8th, according to Carisyoudatalab, the Ministry of Land, Transportation, and Infrastructure, and the Korea Automobile Importers and Distributors Association, the new car registration counted 137,660 units in October, which is a 2.4% decrease from a month prior and a 2.1% decrease from the same month last year. The Korean new car registration counts 113,157 units, which is a 0.3% decrease from a month prior and a 2.3% decrease from the same month last year. The imported cars recorded 24,503 units, which is an 11% decrease from a month prior and a 1.2% decrease from the same month last year. The sales record of light cars began rising after a hesitant moment during the third quarter. Light cars recorded 91,732 during the third quarter, which is an 8.8% decrease from the same season last year. But the sales record for October (10,753) has increased by 8.0% from a month prior and by 2.4% from the same month last year. The light cars seem to be getting more attention due to their relatively lower price during high inflation and high oil prices. It resulted in influencing the sales record of small family cars and small cars. The sales record for small family cars is 30,406, which is a 6.4% decrease from a month prior and a 3.0% decrease from the same month last year. And the sales record for small cars is 10,330, which is a 15.0% decrease from a month prior and a 22.5% increase from the same month last year. The sales record of large family cars (39,798) has increased by 7.9% in the third quarter and approximately 10% during October. On the other hand, the sales record for large cars was 14,084 in October, which is a 22.2% decrease and a 5.6% decrease from the same month last year. Earlier, there had been high growth in the sales record of large cars during the third quarter. It seems like consumers are turning to large family cars instead of large cars. The sales record for full-size cars was 13,132 in October, which is a 14.7% decrease from a month prior and a 17.4% decrease from the same month last year.

Due to the high price of oil, sales of hybrid and electric cars increased, while gasoline and diesel cars had an uneasy time. However, the top-selling new car was a gasoline car in October, with a record of 67,796. The sales record for hybrid cars was 25,982, which was 2.0% higher than a month prior and 65.2% higher than the same month last year. Besides, it was the second most sold after gasoline cars. The sales record for light cars was 22,460 in October, which was a 0.2% decrease from a month prior and a 24.8% decrease from the same month last year. The accumulated sales record of light cars (262,334) overtook that of hybrid cars (249,854), and it also won the second-best fuel category competition. The sales record for electric cars is 15445, which is only 65.2% of the same month last year, yet it seems to be rebounding compared to a month prior (8.9% increase).

Now, I am curious about who will be the main players in October in terms of purchasing new cars. The purchase of female customers decreased from a month before, and there had been a slight increase among male customers. Female customers purchased a total of 28,412 units of new cars, while male customers purchased 66,550 units, an increase of 10 units from a month prior. Compared to the same month last year, the purchase record of female customers has increased by 7.8%, which is advancing male customers (5.7%). In the customer age category, customers in their 50s proved to be the big hand in the Korean new car market by recording 26,441 units in October, which is the most among all the age groups. Yet, the sales record decreased by 1.0% compared to a month prior due to the economic recession and high oil prices. The sales record of other age groups is: customers in their 40s, 23,239; customers in their 30s, 18,801; and customers in their 60s, 16,621, which led the market. The sales record for these age groups compared to a month before is: customers in their 40s, 2.7%▼, in their 30s, 1.1%▼, and in their 60s, 2.0%▲. The sales records of the rest of the age groups are: customers in their 20s, 6,285; customers in their 70s, 3,575. The sales record of Waggon, which is known to sell less than one hundred units at an increase or decrease rate compared to a month prior and the same month last year, was 362. It was a 109.2% increase from a month prior and a 55.4% increase from the same month last year. However, it is not enough to influence the entire trend.

Favouritism for SUVs was solid in the new car market during October. The sales record for SUVs is 67,784, which is a 3.4% decrease from a month prior and a 7.3% increase from the same month last year. With the SUV ahead, 34,705 sedans were sold, which is a 6.8% decrease from a month prior and a 12.4% decrease from the same month last year. In the accumulated sales record, sedans (418,804) are 200,000 units behind SUVs (661,036). 9,219 RVs, 4,479 hatchbacks, and 1,369 pickup trucks were sold.

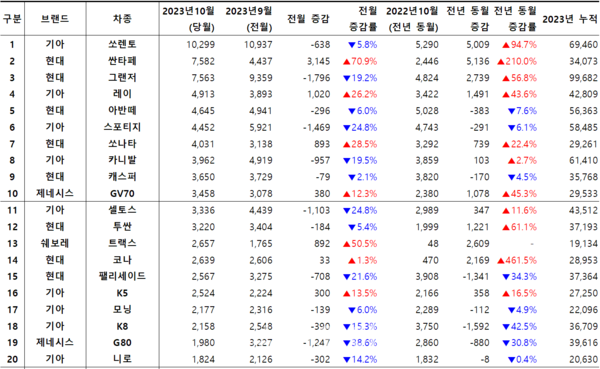

In the brand category, Kia took the top spot by selling 4012 units in the domestic new car sales competition. Hyundai was a little behind Kia by recording 38,749, and Genestis took third (7,447). Chevrollet (4th/3,751), KGMobility (5th/3,470), and Renault Korea (6th/1,434) took the rest of the rankings. The top 10 car types were Kia, Hyundai, and Genesis (Hyundai Car Group) brand cars.

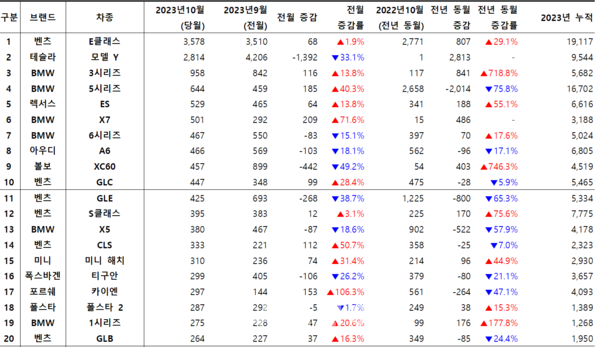

The top brand in the imported new car sales competition was Benz (6,610), which has been maintaining its position for the last three months. BMW (5,985), Tesla (2,829), and Volvo (1,263) took each 2nd, 3rd, and 4th. Tesla has attracted customers with electric cars at a low cost based on car parts made in China.

The accumulated sales record of Volvo was 13771 in October. They have still two months to go until they approach the target sales record (17,500) on the condition that they will sell a minimum of 1865 units a month. The rest of the major brands are Audi (5th/1,149), Lexus (6th/963), Volkswagen (7th/853), Mini (8th/732), Toyota (9th/722), and Porsche (10th/706).

The Japanese car brand has improved. Lexus and Toyota entered the top 10 by having a high record in sales compared to a month prior. Honda ranked 13th in October by recording 233, which is a 121.9% increase from a month before (September 16th). This is due to the new car effect; thus, we have got to watch whether they will recover to their former sales record.

- [Consumption value-Project] ④ Korean Braille Day, industry is initiating enhancement of the quality of life of citizens with visual impairments, which leads to consumption value

- [Consumption value-Project] ③ Delivery apps are leading to a healthy and safe delivery food culture and the restoration of trust. Leading consumption value

- [Consumption value-project] ② Businesses are striving for shared growth, which leads to consumption value

- [Consumption value-Project]① "They've been telling us about ESG practices."...KCG 2023 overall evaluation

- [Consumption value-Project] ⑥ Sharing: From homemade kimchi to charcoal briquettes, citizens, government, and military are sharing

- [Consumption value-Project]⑦ Businesses are practicing ESG through beach cleaning... Consumption value through environmental protection

- [Consumption value-Project]⑧Car: hybrid cars are taking the lead in the new car market.

- [Consumption value-Project]⑨ The car industry is taking a step towards social contribution regarding citizens with low incomes

- [Consumption value-Project] ⑪ The delivery app industry is practicing ESG through volunteering and shared growth, "from the delivery of briquettes to caring for riders in cold weather.”

- [Consumption value-Project] ⑩ The home appliance industry is leading consumption value by sharing, donating, and volunteering